mississippi state income tax calculator

The Mississippi State Tax Calculator MSS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223. Start filing your tax return now.

Mississippi State Income Tax Ms Tax Calculator Community Tax

5 on all taxable income over.

. Calculate your Mississippi net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4. Calculate your total income taxes. Your average tax rate is 1198 and your marginal.

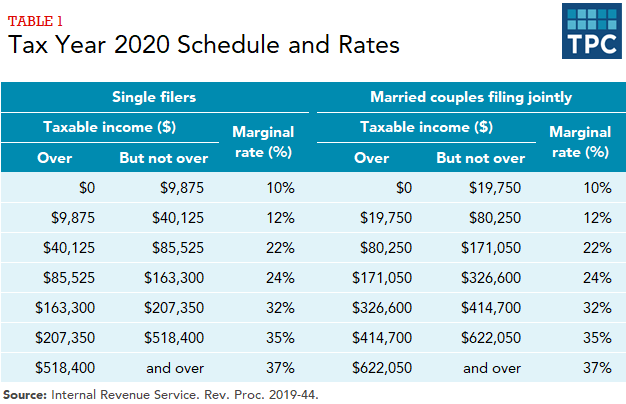

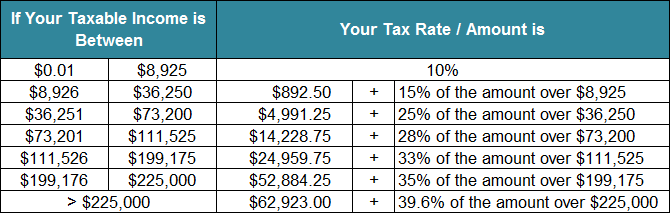

4 on the next 5000 of taxable income. Select Region United States. You will be taxed 3 on any earnings between 3000.

You are able to use our Mississippi State Tax Calculator to calculate your total tax costs in the tax year 202223. Updated for 2022 tax year. The Mississippi State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Mississippi State Tax CalculatorWe also.

To estimate your tax return for 202223 please select the 2022. Our income tax and paycheck calculator can help you understand your take home pay. If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472.

If you make 100000 a year living in the region of Mississippi USA you will be taxed 19594. Our income tax and paycheck. All other income tax returns P.

TAX DAY IS APRIL. The graduated income tax rate is. Mississippi Code at Lexis Publishing Income Tax Laws Title 27 Chapter 7.

Click on your state or use the table. The Magnolia States tax system is progressive so taxpayers who earn more can expect to pay higher marginal rates of their income. Estimate Your State and Federal Taxes.

If you make 195500 in Mississippi what will your salary after tax be. Mississippi state tax 6035. Mississippi State Unemployment Insurance SUI As an employer youre responsible for paying SUI remember if you pay your state unemployment tax in full and on.

The state income tax rate in Mississippi is progressive and ranges from 0 to 5 while federal income tax rates range from 10 to 37 depending on your income. 0 on the first 4000 of taxable income. 3 on the next 1000 of taxable income.

Mississippi Salary Tax Calculator for the Tax Year 202223. Your average tax rate is 1501 and your marginal. Mississippi Income Tax Calculator 2021.

Federal Mississippi taxes FICA and state payroll tax. Detailed Mississippi state income tax rates and brackets are available on this page. Find a List of State Tax Calculators and Estimates for Tax Year 2021 and 2022.

Our income tax and paycheck calculator can help you understand your take home pay. State Income Tax Calculators. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Box 23050 Jackson MS 39225-3050. Mississippi Income Tax Calculator 2021. Mississippi Salary Paycheck Calculator.

Mississippi tax year starts from July 01 the year before to June 30 the current year.

Tax Calculator Github Topics Github

Mississippi Paycheck Calculator Smartasset

Mississippi Extends Income Tax Filing Deadline For 2020

Calculate The State Income Tax Owed On A 90 000 Per Year Salary Tax Plz Help Me N Plz Brainly Com

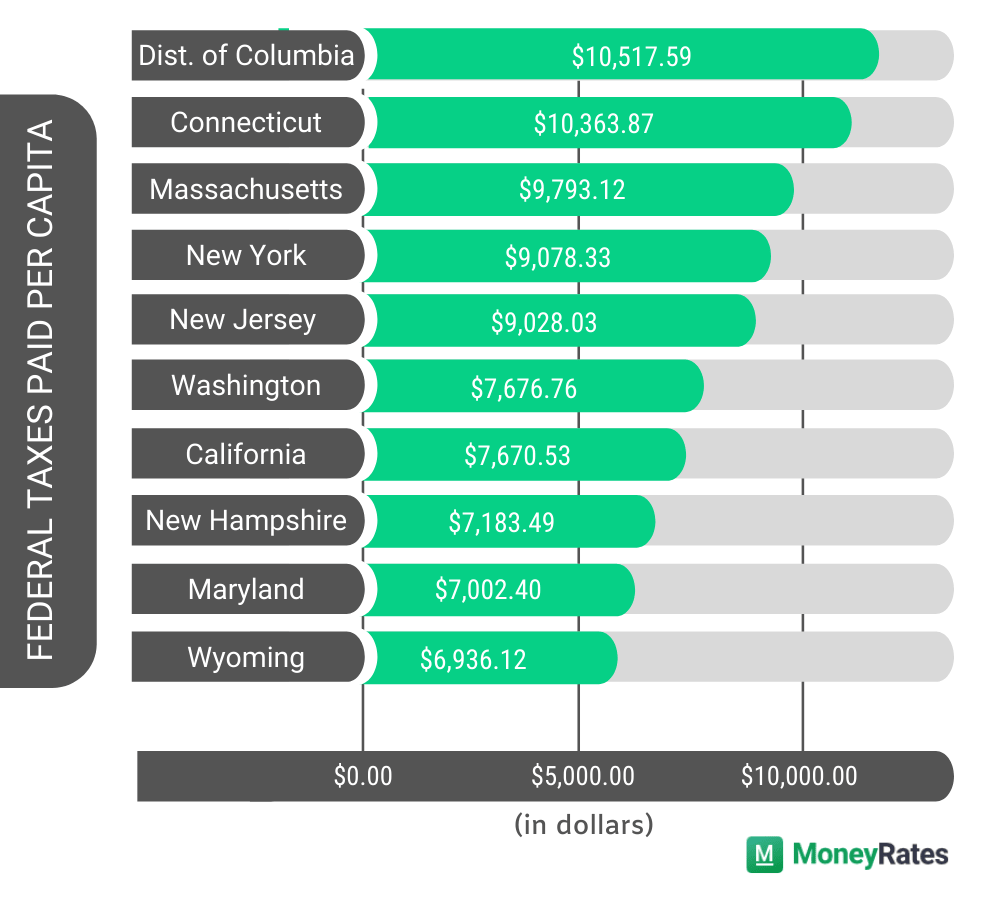

Which States Pay The Most Federal Taxes Moneyrates

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Complete Tax Brackets Tables And Income Tax Rates Tax Calculator Market Consensus

State Withholding Form H R Block

Mississippi State Income Tax Ms Tax Calculator Community Tax

How To Calculate Income Tax In Excel

Mississippi Paycheck Calculator Smartasset

Income Tax Calculator Estimate Your Refund In Seconds For Free

New Jersey Sales Tax Calculator And Local Rates 2021 Wise

How To Calculate Income Tax In Excel

![]()

Income Tax Calculator 2022 Usa Salary After Tax

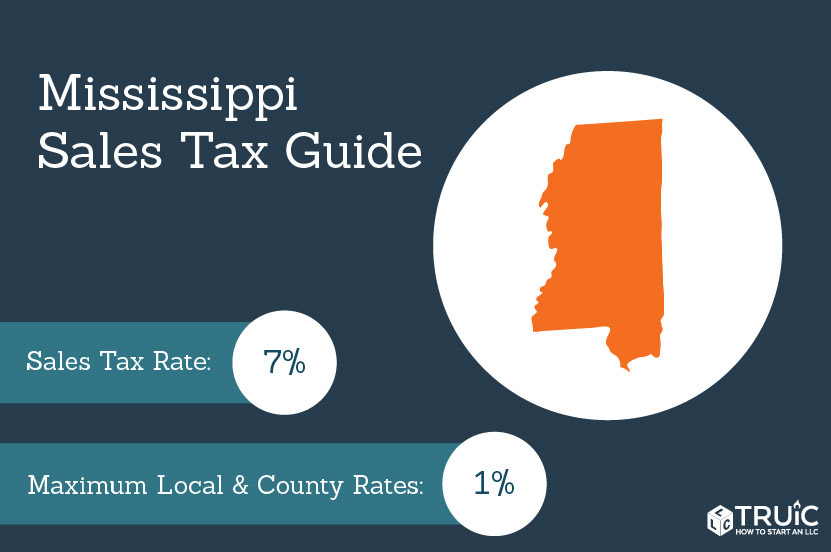

Mississippi Sales Tax Small Business Guide Truic

Cryptocurrency Taxes What To Know For 2021 Money